When confronted by a sudden epidemic, doctors often find themselves unable to provide accurate medical care due to the lack of diagnostic experience of the newfound disease. Thanks to the AI-driven image recognition technology, the screening process became easier than before.

As demand for such technology becomes apparent, China’s medical AI industry receives a favorable treat from the once cautious regulators. The other way round, regulators have also shown their willingness and determination to make policies catch up with technological advances.

In order to establish the regulatory direction of medical AI, the State Drug Administration, the Ministry of Industry and Information Technology, the Ministry of Science and Technology, and the Health and Welfare Commission set up an AI medical device cooperation platform in 2019.

In July 2020, the State Ministry of Industry and Information Technology (MIIT) has gathered 17 medical AI products to test how effective the technology can screen pneumonia. The result? Most of them have passed the test and three of which can further determine whether the pneumonia is caused by COVID-19.

Same with FDA of the US, Chinese medical watchdogs categorize medical devices into three classes, with Class III being the highest risk. Class III devices are those need to enter the human body, such as implantable pacemakers and ultrasound scalpels, therefore are strictly controlled and thoroughly inspected. It is worth noticing that, prior to 2020, not a single Class III medical devices license was ever granted for a medical AI product or service.

The first Class III license medical AI device was approved in January 2020; in the second half of 2020, the approval of such licenses accelerated significantly, adding eight more. As of September 2021, 17 AI medical products have been approved for Class III licenses.

By passing the regulators’ strictest standards, a Class III license is considered a massive endorsement for the product’s reliability. Also, it grants qualification to bill patients, thus opening the door to commercialization. And the market is vast too, due to two factors: China’s growing silver economy and the imbalance of medical resources between first-tier cities and rural regions.

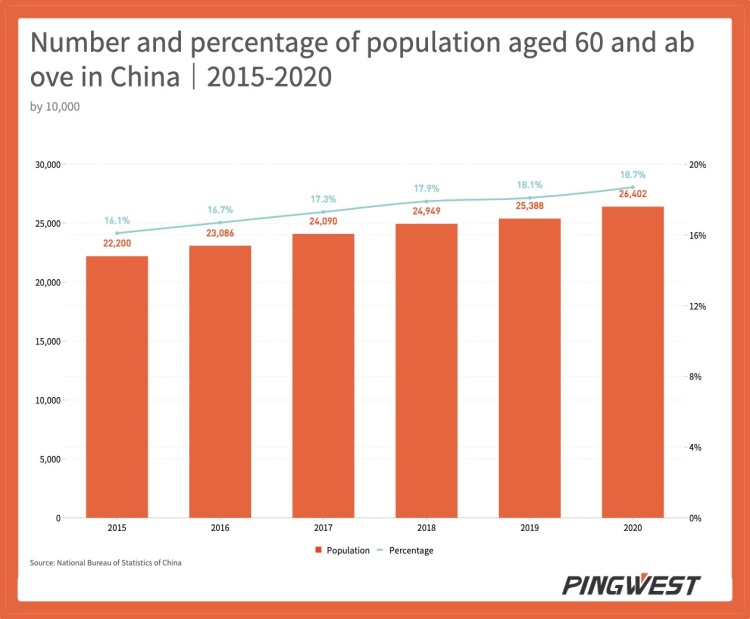

Due to decades of falling birth rates and steeply rising life expectancy, China is one of the countries with the fastest aging population in the world, according to Statista.

The percentage of people ages 60 (the mandatory retirement age) and above in China is expected to reach 35.9% of the whole population by 2030. That is a significantly alarming number, even comparing to Japan, the world’s highest in terms of the aging population — people ages 65 and above in Japan are expected to constitute 38.4% of the total population in 2065, according to research by Japan’s National Center for Global Health and Medicine.

Among the aging population in China, those from rural areas are aging faster than urban areas — with over-60s accounting for 23.8 percent of the rural population, compared with 15.8 percent in cities, according to an SCMP report.

The aging population poses a challenge to the national medical care system but also gives industries like medical AI a chance to shine as the silver economy booms.

The average monthly basic pension was about 170 yuan (US$21.75) in 2020, while a total of 51.7 billion yuan (US$8 billion) was spent on the welfare of elderly people. By the end of 2020, there were 329,000 elderly care institutions and facilities across the country, with a total of 8.21 million elderly care beds, equivalent to 31 beds per 1,000 people, according to an SCMP report.

According to data released by China’s Ministry of Health, 80% of the country’s medical resources are currently concentrated in large cities, and 30% of them are concentrated in large hospitals.

The insufficiency in medical infrastructure is likely to be compensated by the aid of technology, such as medical AI. In rural areas where doctors are either swamped by the overwhelming number of patients or simply lack the experience or expertise to diagnose, medical AI products can provide efficiency and accuracy.

For example, Keya Medical, the first company to be granted a Class III license in 2020, has already established partnerships with over 1000 hospitals in China, according to the company’s website.

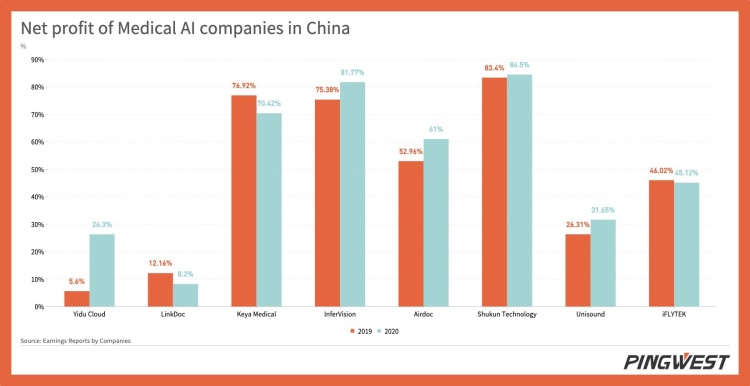

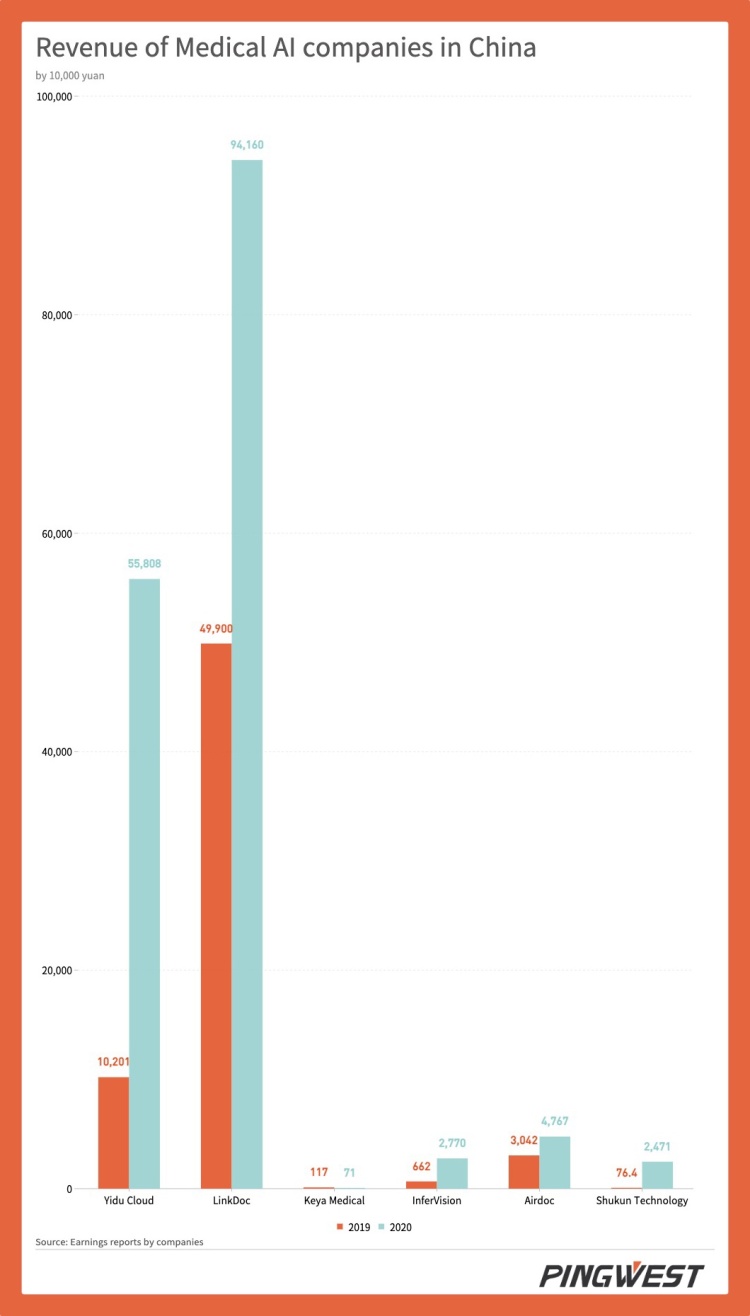

Most of the medical AI companies have seen a rise in their revenue and profit in recent years and are expected to rise even more tremendously in 2021.

Photo by National Cancer Institute on Unsplash