Thanks to the accelerating digitalization in Southeast Asia, the regional tech giant Sea Group keeps proliferating, handing over a solid financial report for the first quarter of 2021.

By standing on 3 core businesses, including gaming, e-commerce, and digital payments, and expanding the scope of business such as food delivery, the giant sees its benefits to its e-payment unit, SeaMoney. Therefore, in the earnings call, the group demonstrates its aspiration, saying that it will continue to develop its own ecosystem and is committed to growing the digital economy in the region.

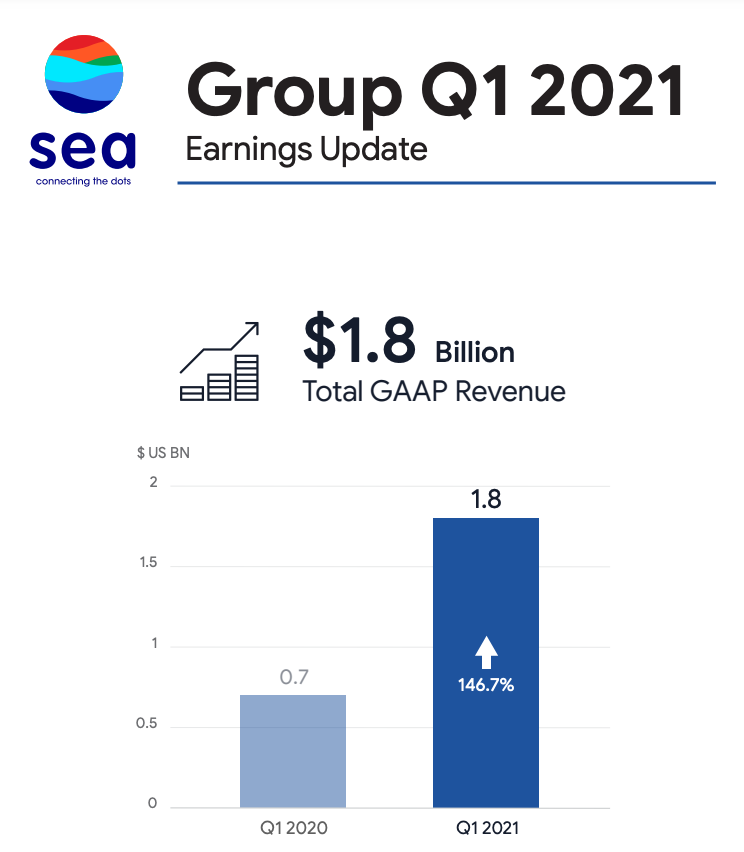

Revenue for the quarter reached $1.8 billion, representing a 147% year-on-year increase, according to the Singapore-headquartered company's latest quarterly report released on May 18. It also recorded an astonishing growth rate in 2020, with total annual revenue reaching $4.4 billion, increasing 101.1% over 2019.

The group's gaming arm Garena raked in $781 million in revenue, up 111% from the previous year. Free Fire, the self-developed MOBA game, remained the highest-grossing mobile game in Latin America, Southeast Asia, and India for the quarter, Sea said, citing data intelligence firm App Annie.

The revenue generated by e-commerce represented by Shopee hit $922.3 million, a year-on-year rise of 250.4%. Gross merchandise value was 12.6 billion yuan, an increase of 103.2% year-on-year.

According to App Annie, in Southeast Asia, Shopee ranked first in the shopping category by average monthly active users and total time spent on Android for the first quarter of 2021. Also, Shopee saw growth in Brazil due to a nascent regional expansion, chairman Forrest Li told in the earnings call.

For the first quarter, SeaMoney's mobile wallet services recorded a total payment volume of $3.4 billion, which more than tripled compared to $1.1 billion a year ago.

"Digital financial services in our region are at early stages and we expect use cases to grow," said Li. The Nasdaq-listed company won a digital banking license in Singapore in December and purchased last year Indonesian lender Bank BKE ( Bank Kesejahteraan Ekonomi) to turn into a digital bank.

The company believes that the most effective way to grow SeaMoney is to cultivate its own ecosystem. ShopeePay, born in e-commerce, has made a massive contribution to the entire digital payment business. Recently, Sea takes the newly started service food delivery as a significant part of the entire e-commerce ecosystem, which is a sustainable opportunity and will bring growth to e-payments.

Through the acquisition of "Now," the most prominent food delivery app in Vietnam, Sea embeds AirPay, its e-payment service facing the Vietnamese market, into the app. The group, which said it will gradually expand food delivery to other markets over time, is testing ShopeeFood in major cities in Indonesia, the home to ride-hailing startup Gojek and e-tailer Tokopedia.

More orders on the delivery platform translate into more digital payment transactions. "Nearly all large tech players in Southeast Asia are pushing towards financial services because of the market opportunity and margins," said Zennon Kapron of research and consulting firm Kapronasia. "With so many of Indonesia's consumers and merchants underbanked, there is a huge opportunity to serve this market. Payments are typically the entry-point as companies build out their financial products and services."

Analysts believe that this has intensified the company's competition with Gojek in Indonesia's food delivery market, leading to elevated marketing costs. In the first quarter, Sea's net loss expanded from $281 million to $422 million as the sales and marketing expenses more than doubled.

But the war is far from over. Gojek and Tokopedia announced a merger on Monday to form GoTo, a new entity valued at $18 billion, concentrating forces to deal with ambitious opponents like Sea and Grab.

Sea is well-positioned in the competition because its highly profitable gaming business provides funds to expand e-commerce and digital financial services. Meanwhile, the Singapore company leverages China's abundant human resources to better serve Southeast Asia. Due to the relative shortage of tech talents in the region, it runs offices in Beijing, Shanghai, and Shenzhen, recruiting a large number of software engineers throughout the year.

Speaking of the consolidation of rivals, Yanjun Wang, Chief Corporate Officer, said, "It's a long runway, and we should all collectively focus on expanding the pie and growing the digital economy in our region."

Image Credits: Rowan Freeman on Unsplash