Editor's note: This article is an English translation of the original Chinese post titled 狂撒优惠券之后,库迪和瑞幸卷起了全球化 by Zhifang Ma published on PingWest Chinese site.

"(We are) the fifth largest coffee chain brand in the world, currently covering 5 countries, more than 300 cities, and 5,000 plus stores," said an international recruitment advertisement for Cotti Coffee, which features Lionel Messi and two other Argentine national team players as its ambassadors.

The first Cotti Coffee location in Japan launched on August 26. Launched in October 2022 by former Luckin Coffee executives Charles Lu and Jenny Qian, Cotti Coffee has officially launched in South Korea, Indonesia, Canada, and Japan in only one year, and it appears they have no plans to slow down their expansion.

Cotti is inextricably linked to Luckin Coffee despite the fact that it is a new coffee chain for many customers. Its menu, marketing strategy, and store location all have some relation to Luckin Coffee.

"Wherever there is Luckin, there will also be Cotti next to it." A post on the Chinese social networking app Xiaohongshu. Cotti has only one objective in terms of market strategy: to blindly follow Luckin.

Luckin, which insists on direct sales until 2021, lags far behind Cotti in terms of the rate of store openings, whereas Cotti has relied on a franchise model from day one. It took nearly five years for Luckin Coffee to open its 10,000th store. Although Luckin is currently the first coffee chain in China to have more than 10,000 stores, Cotti Coffee is catching up quickly by just surpassing the 5,000 milestone in less than a year.

Cotti Coffee has not hidden its relationship with Luckin. Those who compare Cotti's money-wasting expansion strategy to Luckin's often contradict the relationship between the two companies. Charles Lu, dismissed from Luckin due to a financial fraud scandal, has launched two new businesses, the noodle shop Qu Xiaomian and the pre-made food brand Shejian Hero, but neither has been successful.

The rapid expansion of Cotti Coffee is therefore not unexpected. Charles Lu and Jenny Qian may have difficulty obtaining substantial capital support this time. From the perspective of store distribution, Luckin Coffee is more attentive to the needs of white-collar frontline workers than Cotti Coffee.

- Cotti Coffee has over 5,100 locations. 38.17% of store locations are located in offices across the nation, followed by shopping malls (28.7%) and residential compartments (24.94%).

- Luckin Coffee has more than 11,000 stores, and its location preferences are comparable to those of Cotti, but in various proportions: office space (44.01%), retail (25.2%), and residential (18.81%).

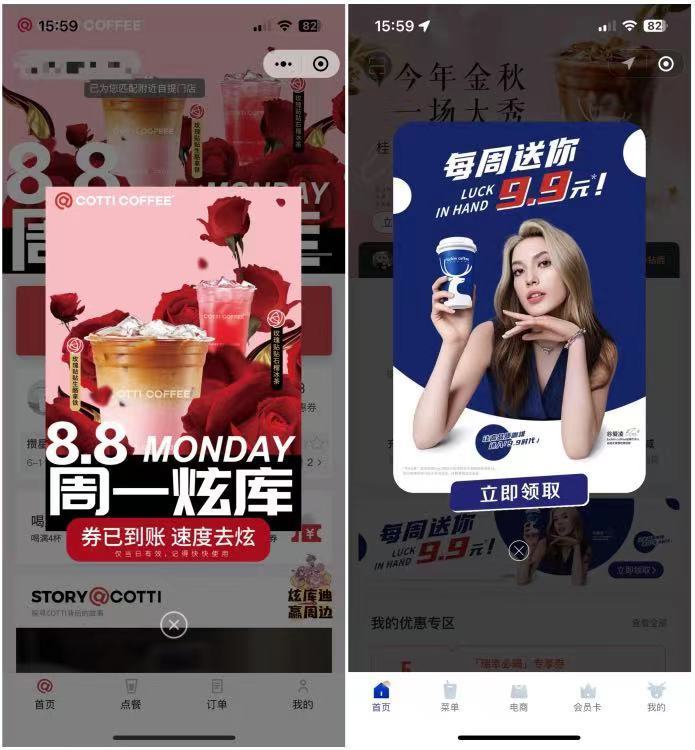

Due to their similarity, Cotti does not hesitate to engage in a price war to win over consumers. During the months-long price war, the Cotti store displayed a banner that read, "Luckin's founder will buy you a coffee for 8.8 yuan ($1.21)." For Luckin Coffee, it sends you a 9.9 yuan ($1.36) coupon.

The competition between Cotti and Luckin has reduced the market share of other coffee brands, to the benefit of consumers of both brands of coffee. According to the financial report for the second quarter of this year, Luckin Coffee's net profit exceeded that of Starbucks for the first time. Not only did the conflict with Cotti Coffee have no negative impact on vitality, but it also produced exceptional results. Two years will pass before the event featuring 9.9 yuan vouchers ends.

According to a report from the coffee industry, the majority of coffee drinkers in the United States are under the age of 40. Cotti's response to Luckin's brand proposition, "Who doesn't love this cup?" was, "Drink Cotti, you will be younger." It appears that Cotti Coffee is committed to attracting young consumers.

Cotti Coffee has laboriously created an environment that is roughly comparable to Luckin. Due to the intense competition on the domestic market, Cotti chose to acquire a competitive advantage abroad.

世界中に開業するのが難しいコーヒーショップが存在しないように力を入れてまいりました。(We've been working hard to make the world a place where there are no difficult-to-open coffee shops.)

This provocative statement can be found on the Instagram account of Cotti in Japan. This coffee brand seems more concerned with stimulating the minds of entrepreneurs than promoting its products.

Cotti Coffee does not favour the direct operation model, whether due to financial constraints or a belief in the efficacy of joint ventures. In fact, Cotti Coffee aims to assist micro, small, and medium-sized enterprises around the globe in achieving their coffee goals.

Jenny Qian, chairman and chief executive officer of Cotti, states in the company's profile that he is a "coffee dreamer" and that he created the "Coffee Dreamer Plan" to assist coffee enthusiasts and entrepreneurs in achieving their coffee ambitions so that there is no challenging coffee establishment in the world.

According to reports, there are three models of international cooperation for Cotti: direct stores, joint stores, and regional associates. The first international store, which opened on August 8 in Seoul, South Korea, is rumoured to be a direct store.

In addition to entering South Korea, Indonesia, Japan, and Canada, the brand will reportedly open stores in the United Arab Emirates, Vietnam, Malaysia, and Thailand. And each market has its own unique methods of collaboration. In certain markets, regional partners are the primary recruitment targets for significantly expanding the number of stores.

Regional partners can receive store opening incentives and operating commissions, according to Cotti's current policy; regional partners must have at least one store in the region and have sufficient workforce to engage in operations. In principle, there are no national-level collaborators.

Partners have been enlisted in desirable neighborhoods of popular cities in a handful of popular nations. Combined with the other two cooperation models (direct operation and collaborative operation), it is anticipated that Cotti Coffee's overseas stores will expand swiftly and appear in a large number of countries.

Luckin Coffee opened its first two locations in Singapore on March 31, 2018. PingWest learned at that time that Singaporean employees of Luckin had received training in China and the menu kept all standard as in China.

In contrast to Luckin's subdued style, Cotti's is quite aggressive. Cotti consistently emphasises in overseas social media updates that the brand is the second venture of Luckin's founding team, which is identical to the company's strategy for penetrating the Chinese market. Cotti noted in the overseas investment documents that Luckin has surpassed Starbucks China, emphasizing the aura of the founding team even further.

How can quality control be implemented internationally while capturing market share and opening as many stores as possible? How can products that are appropriate for the local market be introduced? This is a difficulty that Cotti must surmount. Due to Luckin's optimistic domestic performance and Flash Coffee's existing competition in Southeast Asia with a comparable business model, Cotti Coffee's proactive attack against Luckin's globalization may be ineffective.