Located in the eastern part of the Pearl River Delta, Huizhou Samsung Electronics, Samsung’s largest smartphone factory in China has been a major promoter of local economic growth, at least when it was in full production capacity.

With the Korean electronic giant’s failure in the Chinese smartphone market, its Huizhou subsidiary has seen better days.

In June this year, media reports came out showing that Samsung’s cutting production as well as laying off workers in the Huizhou factory, with the possibility of shutting down once and for all, following similar closures as the company's Shenzhen and Tianjin plants. Although Samsung officially denied the rumor of shutting down, according to the South China Morning Post, the Huizhou factory is indeed conducting layoffs.

Homegrown low-end and premium mobile phones crowded out Samsung

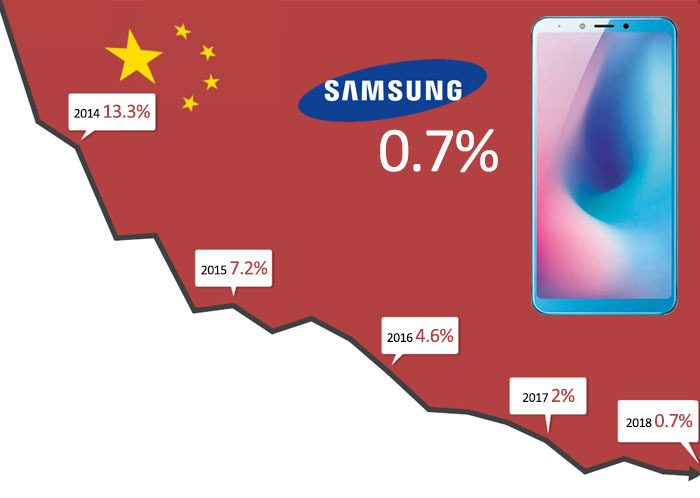

Samsung has retained its crown as the top global smartphone vendor for 2018 in terms of overall global smartphone shipments. Meanwhile in China, its smartphone market share had just reached the lowest since 2013, once touching 0.8% in 2018, the lowest point ever, according to its financial reports. An infographic created by Korean newspaper The Chosun Ilbo showed that Samsung’s smartphone market share has been in steep decline since 2014.

At the beginning of the smartphone era, Apple revolutionized the smartphone industry, and Samsung had done all it can to catch up. Its Galaxy branded smartphones has been vastly popular early on with Chinese consumers, partially resulting from the iPhone being late to the market due to local authorities’ push for another connection standard to replace Wi-Fi.

For a long time. Samsung phones were considered premium and its latest generation were highly sought after. When Xiaomi, OPPO and other Chinese mobile phone companies were still focused on the low-end market, utilizing the subsidies from selling carrier-locked cost-effective smartphones, Samsung has almost become the overlord of the Chinese Android phone industry. In 2012, Samsung sold 37 million smartphones in China, with a significantly larger market share of 17% overshadowing local competitors, according to a report by Chinese market research company IDC.

In 2013, Samsung continued to outgrow competitors through high-quality devices combined with overwhelming marketing campaigns. That year, one in every five smartphones sold in China is from Samsung, according to Strategy Analytics, further enhancing the Korean brand’s dominance in China.

Not to be outdone, numerous talents, capital and resources have been poured into research and development field by Chinese phone makers in order to draw level with Samsung. They chose the value-for-money route again, this time with their own premium and highly competitive budget handsets.

One of Samsung’s most fierce rivals was Xiaomi. Lei Jun, the company’s co-founder and CEO claimed that in order to woo customers and compete with “friendly competitors”, he is willing to maintain the company’s hardware profit margin under 5%. Following Apple’s annual launching pace,Xiaomi introduced its premium phones as well as even cheaper budget devices several years in a row, while keeping Lei’s words.

In the face of the cost-effective epoch pioneered by Xiaomi and other Chinese manufacturers, Samsung's low-end smartphones started to gradually lose competitiveness.

In recent years, Huawei has been catching up quickly, producing some of the most technologically advanced mobile phones in the past three years. It was the first to release smartphones with high zoom ratio camera, dedicated neural computing units for faster on-device artificial intelligence processing, as well as reverse wireless charging, which the company claimed can be helpful to charge a user’s other device, a subtle poke at iPhone’s smaller-sized batteries.

According to a June report released by Counterpoint Research, Huawei has surpassed Apple and Samsung to become the current top player with a market share of 48% in the premium smartphone market in China. Not to mention Samsung, which has been neglected by consumers for a while.

It is widely believed in the industry that Samsung China performed weakly in offline distribution channels, unlike domestic brands thriving through increased online sales.

Samsung’s smartphone sales in China also suffered from the globally notorious Galaxy Note 7 battery explosion fiasco. The batteries found in many exploded devices were originally made and assembled by Samsung’s local factories in China.

Samsung’s last push to stay relevant in the tech-savvy Chinese smartphone world was with the launch of Galaxy Fold, the world’s first foldable smartphone. Following its winning recipe, it launched a massive marketing campaign and let Chinese influencers review the device. However, the campaign flopped due to the foldable screen having inherent flaws and that paperwork sent to influencers with the review units did not warn them to not tear of the protective layer on the screen. Galaxy Fold’s official launch was postponed indefinitely.

In 2018, smartphone shipments reached approximately 398 million units in China, representing a 10.5% decrease from the previous year. With the domestic market over-saturated, manufacturers pursued to expand footprints globally, further eroding the markets Samsung once reigned.

So far, they have been successful. Xiaomi maintained its leadership in the Indian market, growing by 8.1% in the first quarter of 2019 compared to last year. It continued to dominate the online channel with 48.6% share. In the meantime, Samsung stayed in the second position with a year-on-year decline of 4.8%.

Vivo and OPPO are poised to overtake Samsung in the next one year in the sub-20,000 rupee budget smartphone segment, which accounts for 78% of the Indian market. According to the Economic Times, the two brands have also approached several smaller cellphone stores, asking them to reduce their focus on Samsung smartphones, promising to compensate for their potential loss of the business.

In Q4 2018, OPPO’s market share in Thailand grew an impressive 69.8% year-on-year with 22.2% market share, surpassing Samsung’s 21.1% cut of the market, according to Canalys report. Unfortunately, Samsung saw a 36.1% year-on-year decline there.

IDC's latest data shows that Samsung’s worldwide shipment volume dropped 8.1% to 71.9 million units in Q1 2019. While still topping the game in net numbers, its growth has been non-existent. Meanwhile, Huawei saw smartphone shipments jumping to 59.1 million units, representing a significant increase of 50.3%, occupying 19% of the global market share as a result.

Samsung is trying to re-emerge energetically in the Chinese market through 5G technology

The performance of Samsung’s smartphone sector may be getting worse, but the income from its smartphone-related supply chain is strong enough to make up for the entire company.

Report from Xinhua News Agency said the sales of the South Korean behemoth's chip exceeded Intel in 2017, making Samsung the world's largest chipmaker. Revenue from its chip arm accounts for one-third of Samsung Electronics’ total revenue. Due to the robust demand for storage chips to be used in handheld devices, Samsung’s chip revenue is expected to keep a solid growth momentum.

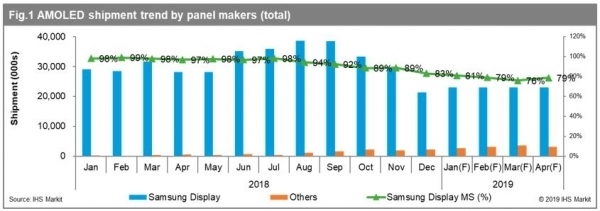

The company also dominates mobile display production worldwide. As the trend in smartphones shifts aggressively from LCD towards OLED, Over 61% of the global smartphone shipments in the last 12 months featured OLED panels of some sort, in which Samsung controls roughly 93% of the business in Q3 last year, according to IHS Market. China manufacturers such as BOE and Tianma follows the Korean competitor with a mere 7% share combined.

Yoo Jong-woo, an analyst with Korea Investment & Securities said Samsung Display, which holds the upper hand in the smartphone OLED market, will maintain its lead in the segment for a long time.

Samsung has also been a strong contender in 5G technology. Korean media outlets reported on Monday that the company is planning to launch its own 5G baseband chips later this year, and that Chinese brands including Vivo and OPPO have received prototype products for testing purposes.

Samsung also actively participates in 5G network testing with all three of China’s major carriers.

Speaking of the localization plan, Kwon Gye-hyun, president of Samsung Electronics Greater China, declared that the company will boost investment in technology and products, especially in the 5G field. "Besides, Samsung will develop more products and services to meet Chinese consumers' needs,'' said Kwon.

The company is again doing a marketing campaign to boost the sales of its Galaxy S10 and other devices as well as its 5G impression among customers. Consumers who buy Samsung's Galaxy S10 series or Galaxy A80 4G smartphones between July 1 and Aug 31 through any Chinese channels authorized by the company can spend an additional 99 RMB ($14.40) to join the Samsung 5G club to upgrade their current handsets to 5G smartphones later this year.

"With the announcement of our 5G plan in China, I'm looking forward to seeing Samsung re-emerge energetically in the Chinese market. " Kwon said.

Combining Samsung’s technological advancements in storage chips, display and 5G, the company might still be able to achieve what the Greater China president envisioned, despite its smartphones have long lost its magic.